The Payday Loan Crunch - Why Not To Get A Payday Loan

The Payday Loan Crunch - Why Not To Get A Payday Loan

Blog Article

After the state of bankruptcy, it is necessary to build the same amount of trust and credibility. One can even apply for auto financing the next day. When it comes to finance a car after bankruptcy, the first thing that you need to do is to build up your credibility once again.

You can either buy a new or used car but before doing so you need to sort out everything regarding the loan. If you sort out the finance then you will know how much money you can exactly afford to pay or spend. There are certain rules which can help you regarding car finance in Australia.

If you want to go up the ladder of success then experience is very much essential. You can try for the bigger companies as well as the bigger salaries of you have enough experience in this field.

At first you're relieved - the negotiating is over. But then the salesman walks you down a back hallway to a stark, cramped office with "Finance and Insurance" on the door. Inside, a man in a suit sits behind the desk. He greets you with a faint smile on his face. An hour later you walk out in a daze: The whole deal was reworked, your monthly payment soared and you bought products you didn't really want.

What's great about this is if the property goes up $50,000 and you sell it for $450,000 then you get to keep the extra $50,000. You can then use that money to get another property if you like. This is why it is in your interests financial advice to buy a property and then clean it up because it adds value which you get to keep once you on sell the property.

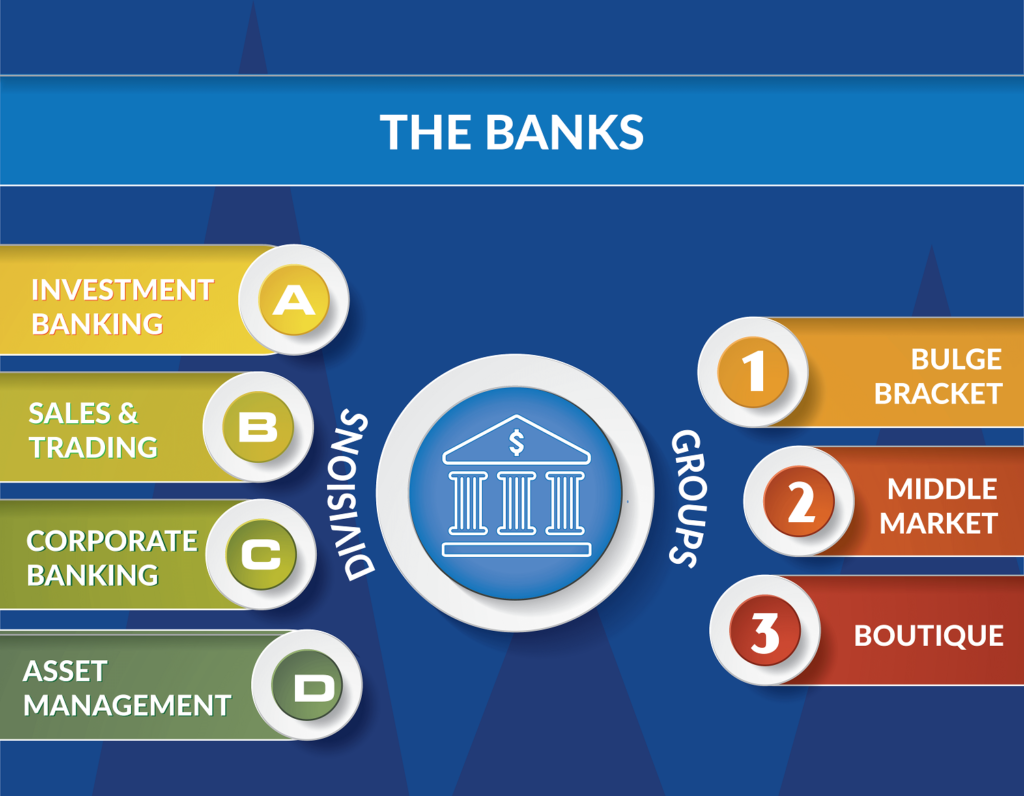

One of the most popular and sought after jobs is the banking jobs. The banks usually have branches in every city and it belongs to the financial sector.

You have many options when it comes time to finance a vehicle. The best way on how to finance a used car for the best rate and terms is to shop around and find the best loan that reflects your best personal interest.

Report this page